Introduction

CEOs of billion-dollar companies have called annual budgeting “the most ineffective practice in management” and “in the best case, totally unnecessary, and in the worst case, actively harmful.”

We can use first principles thinking to understand why. A company’s results are shaped by only two factors: decisions and luck. ‘Actively harmful’ refers to both: hindering decision-making and neglecting the influence of luck.

While some may view luck as a ‘soft’ factor, reasoning that top performers never complain about conditions—they simply deliver results—ignoring luck’s impact leads to rewarding for ‘dumb luck’ and punishing for ‘noble failures.’

Put differently, without accounting for the influence of luck, it is impossible to recognize true performance or identify real high performers.

A ‘noble failure’ is well illustrated by Jeff Bezos’ quote: “Given a 10 percent chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten.”

In other words, risky bets—necessary for maximizing performance—carry a chance of failure independent of skill or effort.

Annual budgeting doesn’t account for the influence of luck because its characteristics make it deterministic. By design, it rewards dumb luck and punishes noble failures, making it one of the reasons it is ‘actively harmful.’

Similarly, by design, it inevitably hinders decision-making for a few simple reasons.

First, due to its time horizon (calendar year) and cadence (12 months), it fails to account for the impacts of major decisions, creating a short-term cost bias, and results in either considerable delays or a lack of decision-making altogether.

Second, it is antithetical to learning, as it leaves no room to adapt based on real-world changes. Consequently, the plans created become disconnected from reality.

Third, since people are aware of these limitations, annual budgeting creates bad behaviors: lying about what is really happening in the business and ‘cheating’ to hit the plan. These behaviors occur not because people are bad or incompetent but simply because the system rewards such behaviors.

Finally, it’s siloed. Instead of focusing on the whole, it prioritizes improving individual parts, which can never maximize overall performance.

#1 Disconnected from Reality

It is impossible to use annual budgeting as an effective decision-making system, including target setting (targets are decisions about what is important), because its 12-month cadence and time horizon don’t align with the characteristics of real business decisions.

It’s easy to test: list the 10 to 20 biggest decisions that impact the company’s performance. Underline those that are best made only once a year and have a decision lifecycle (time it takes to make, execute, and commit to a decision) shorter than 12 months. Then, divide the number of underlined decisions by the total number of decisions. The resulting percentage represents the potential effectiveness of annual budgeting. Odds are, it is 0%.

This means that either annual budgeting is not used to make real decisions, or it adds unnecessary, arbitrary delays while overlooking the significant impacts of major decisions. Either way, it’s ‘actively harmful’ to company performance.

For the same reasons, static targets derived from annual budgeting plans are prone to a short-term cost bias. Targets tied to a calendar year not only allow but actively incentivize ‘cheating’ to achieve them at the expense of long-term performance.

Furthermore, because annual budgeting is deterministic while the real world is probabilistic, it is likely that by the end of the year, plans that were once challenging but realistic will have become either unrealistic, not worth executing, or too easy and inadequate to achieve great performance.

#2 Deterministic

Annual budgeting is built on fundamentally flawed assumptions: that the future can be predicted precisely, making static plans and targets effective; that pursuing those targets equates to maximizing the company’s long-term performance; and that failure to meet targets must result from a flawed plan or poor execution.

While this may seem logical, it contradicts the fundamental characteristics of the real world. Thinking it’s possible to capture a probabilistic world in a deterministic plan is like assuming you can walk on water: regardless of the effort, real-world properties—such as human density, gravity, and water’s surface tension—make it impossible.

The probabilistic nature of the world was proven by Edward Lorenz with the ‘Butterfly Effect,’ whose business implications were summarized by Michael Mankins: In complex systems, small changes in one variable may have no effect or a massive effect, making it practically impossible to predict what will happen.

This leads to another misconception, often referred to as ‘resulting’ or ‘outcome bias,’ which Cassie Kozyrkov calls “one of society’s favorite forms of mass irrationality.” It refers to the tendency to believe that a decision’s outcome reliably reflects the quality of the decision, even though the two are fundamentally different.

In reality, a single outcome cannot reveal whether a decision was ‘good’ or ‘bad,’ as outcomes are influenced by luck. Without accounting for this, it is impossible to determine whether results stem from poor decisions, poor execution, both, or neither.

This flawed thinking leads not only to blaming people for ‘noble failures’ and rewarding them for ‘dumb luck,’ but also to preventing the company from changing decisions when needed, improving execution when necessary, and staying on course when neither are to blame.

#3 Antithetical to Learning

Annual budgeting process produces a static plan, as it lacks a mechanism to test and update the plan based on real data. As several authors have noted (for example here, here, and here), static plans are antithetical to learning, since they remain unchanged when the real world around them changes.

Sticking to static plans is akin to a scientist developing a new drug who sticks to the pre-determined outcome regardless of what the real-world data tells her. In other words: it’s unscientific or nonsensical.

A plan (and the decisions within it) is only valid under specific assumptions about real-world factors. Without a mechanism to revise those assumptions, both the plan and its decisions become invalid—and sticking to them is ‘actively harmful.’

While this may seem obvious, a deeper explanation lies in Ashby’s Law of Requisite Variety.

As Steve Morlidge has described it, “it says, if you’ve got a volatile environment, you need a flexible process, and if you define tight goals, you need a flexible process. So, if you’re in a volatile environment, which we are now, and you’ve got an inflexible process and thousands of targets, it’s not going to work. It can’t work.”

Put differently, the annual budgeting process is by its characteristics a system that can never work well in the real world, regardless of how long it takes to complete, how much the templates or process steps are fine-tuned, or what software is used to make it smoother.

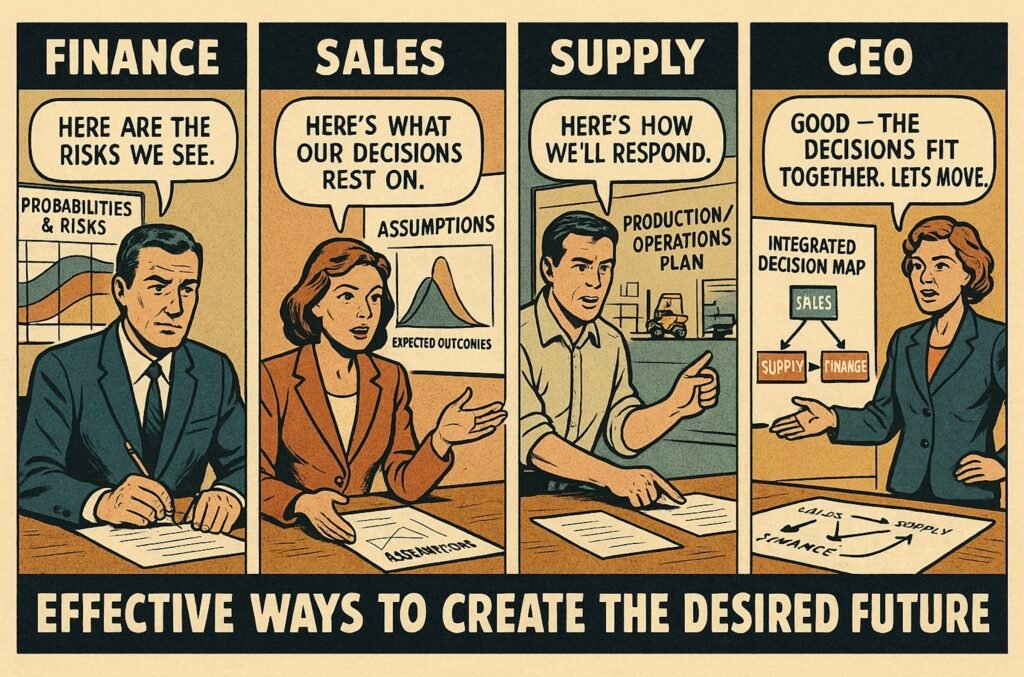

#4 Creates Bad Behaviors

As a corollary to earlier points, annual budgeting incentivizes lying about what is really happening in the business and ‘cheating’ to hit the plan. People are not naïve; they recognize that the future cannot be captured in a static plan, and when it is, the level of difficulty becomes unpredictable.

Since most people cannot change the system, they do the only thing within their power: try to improve their odds of meeting the plan by making it ‘dynamic’—adding hidden buffers and telling stories that exaggerate difficulties and hide opportunities.

This behavior appears at all levels of the organization. Lower levels argue for easier targets by exaggerating challenges and hiding opportunities, while top levels build safety margins into overall numbers by setting unrealistic stretch targets in case some areas fall short or ‘something unexpected happens.’

As a result, annual budgeting becomes more of a political negotiation than a genuine attempt to understand what is truly happening in the business and what should be done to improve performance as one integrated team.

Consequently, plans and targets are rarely based on ‘critical challenges or opportunities.’ Instead, they often resemble what Richard Rumelt describes as ‘Dilbert-style management,’ with arbitrary targets such as +10% or psychologically satisfying figures, like $1 billion.

Additionally, the characteristics of annual budgeting enable ‘cheating’ to hit the plan. Since the major impacts of decisions are often out of scope (such as future revenue from new products), short-term results can be artificially inflated at the expense of long-term performance (e.g., by cutting marketing costs).

#5 Siloed

At first glance, annual budgeting may seem like a holistic and integrated way to steer company performance, but in reality, that’s an illusion.

While there might be one overarching number, like company-wide margin, that is most important ‘to hit,’ there are typically numerous other fixed targets across business units and functions that also ‘need to be hit.’

In addition, many of these silos are further divided into static time buckets, such as months or quarters, and adding these dimensions can quickly multiply into tens or even hundreds of silos that the organization attempts to “hit.”

This doesn’t even account for implementations where numerous revisions cause the process itself to become disjointed, disconnecting the links between, for example, sales plans, operations plans, and financial plans.

Siloed plans lead to siloed and rigid resource allocations, preventing the company from reallocating resources according to the highest expected value over the long term. Instead, each silo owner fights to maximize their resources to meet individual targets, even if this undermines the performance of the company as a whole.

Moreover, even in the (unlikely) case where the company was focused solely on the performance of the whole, it would, by definition, still focus only on the silo of a single calendar year, neglecting the decision impacts beyond year one.

In theory, this could lead to maximizing performance only if the company made no decisions (including ‘not deciding’) with impacts extending beyond the calendar year.

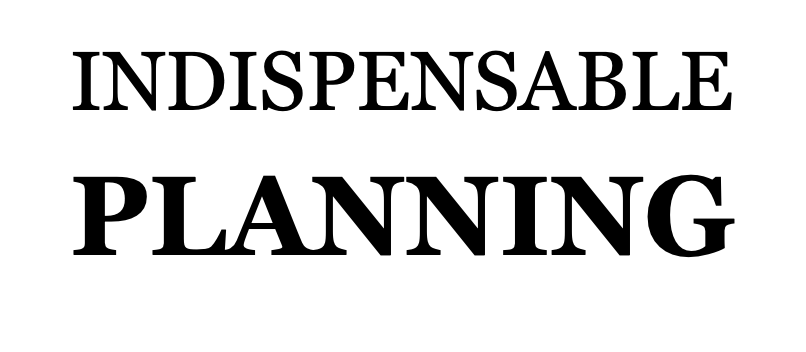

A Better Way

The reason why annual budgeting becomes ‘actively harmful’ is that, by design, it creates a view of reality (AOP, budget, targets, etc.) with a practically nonexistent chance of aligning with what would maximize company performance.

Put differently, it creates a Sophie’s choice for employees: whether to ‘follow the plan’ and ‘hit the targets’ or to make decisions that would best improve the company’s ‘odds to win.’

For annual budgeting to be ‘actively beneficial,’ the following changes would need to be made to align plans and targets with reality, as well as employees’ interests with what maximizes the company’s performance.

First, as Richard Rumelt recommends, target setting should be an outcome of strategy formulation (working the gnarly problem of strategy, instead of annual political negotiation), based on ‘critical challenges and opportunities.’ This may mean setting targets 3 to 4 years out and giving people ample time to reach them. Additionally, as McKinsey recommends, when risk levels increase, a larger portion of individual incentives should be tied to collaborative objectives (while ensuring there are no free riders).

Second, as a corollary to the first, the time horizon would need to cover most of the impacts of major decisions to ensure they are included in the discussion. Additionally, the cadence would need to be at least 20 times shorter than a typical decision lifecycle to avoid unnecessary delays in decision-making (annual cadence suits decisions with lifecycles of 20+ years).

Third, there needs to be a built-in mechanism to revise plans based on real-life data. This would mean adjusting decisions when real-world assumptions—such as market growth or decline—change. Similarly, targets would need to be dynamic or revised when critical challenges or opportunities change, ensuring they remain both challenging and realistic under varying conditions outside the company’s control.

Fourth, to prevent and expose sandbagging and the creation of hidden buffers, companies should “invite Mr. Bayes” into the process, using probabilities to describe targets, outcomes, and assumptions. This would help the company focus on overall performance by recognizing that not all deviations between ‘planned’ and ‘actual’ are significant, as some contain random noise, and it would enable rewarding risk-taking by recognizing ‘noble failures.’

These changes would not only reduce the incentive to lie but also limit the opportunity to cheat to achieve results, shifting the focus of the planning process to performance rather than to who can negotiate the largest hidden buffer. They would also make achieving results more about skill and effort than about luck or who is willing to make the most harmful short-term suboptimizations.

This would align personal incentives with decisions that are best for the company’s performance, and make it possible to maximize the ‘odds to win.’

Practical insights

- Annual budgeting creates a view of the world that is disconnected from reality.

- Failing to account for the influence of luck leads to rewarding ‘dumb luck.’

- Static plans are, by definition, unscientific and antithetical to learning.

- Deterministic systems in a probabilistic world inevitable create bad behaviors.

- Focusing on ‘hitting’ numerous silos can never optimize the whole.