If you’ve ever discussed the rationale behind traditional Annual Budgeting or Strategic Planning, odds are you’ve heard an argument something along these lines: “It’s beneficial to have a ‘deep dive’ into the business.”

This often follows an acknowledgment that neither process is an effective way to make decisions: “Yes, but it’s still useful to gain an in-depth understanding of what’s going on in the business.”

While gaining such insight may be useful, it’s also likely a sign of ineffective decision-making. If such a deep dive is indeed beneficial, it indicates one of two problems: either the company is unnecessarily delaying decisions, or it is making decisions without a good understanding of the business.

Most likely, it’s the latter—though, to be precise, it’s often a mix of both.

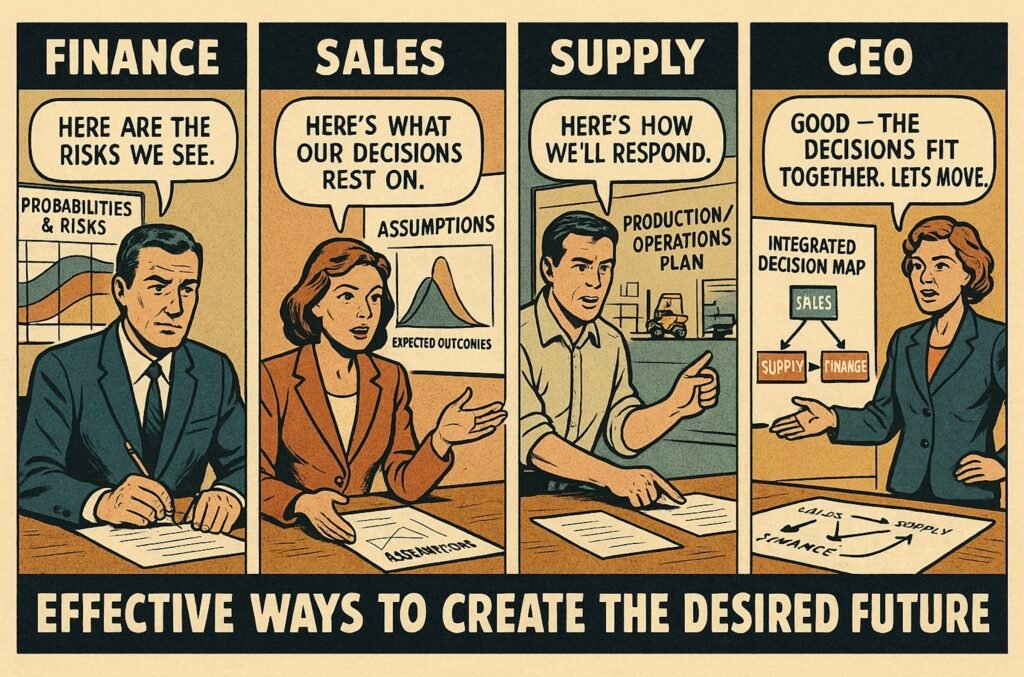

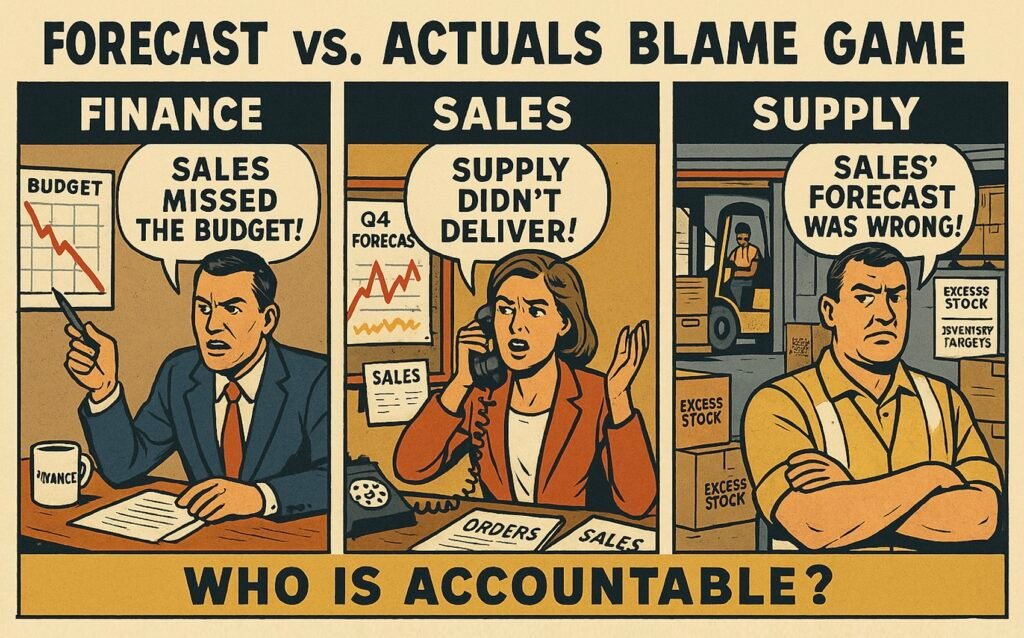

Most companies make decisions continuously, but they do so in silos (often on a ‘case-by-case’ basis), which prevents a comprehensive understanding of overall performance. As a result, decision interdependencies are poorly understood, leading to ineffective decisions and some being unintentionally—and unnecessarily—delayed.

R&D decisions are made in one silo (which may or may not involve some cross-functional collaboration), sales-related decisions—such as pricing—are made in another, supply chain decisions occur in a third, and financial models, along with related decisions (e.g., acceptable capital levels), are calculated in Todd’s Excel in the FP&A department.

The next time someone praises the benefits of the ‘deep dive’ in September for planning the next year, ask them this: “Why have you delayed decisions that impact next year—such as new product launches, pricing, digital tools, new production lines, or hiring and firing—for so long?”

And when their response is some variation of: “Well, of course we’ve made all those decisions continuously,” ask them this: “How effective can those decisions be if you don’t have a clear understanding of what’s happening in the business?”

They’ll likely either say it’s for decisions made after the deep dive or claim it’s some form of ‘background information’ or an effort ‘to get everyone on the same page.’

The latter is the less likely answer—and odds are, no such decisions exist. Even if examples are provided, there’s hardly any real-life justification for why they are best made annually (other than ‘that’s how we’ve always done it’), or they are rare exceptions that fail to justify the extensive work required for a deep dive.

The most likely answer is to claim that the deep dive is indeed some sort of background alignment exercise with beneficial ripple effects ‘somewhere.’

And while it’s probably best to leave it at that, that’s simply another way of saying that, for the rest of the year, stakeholders are either misaligned or lacking crucial background information to make the best possible decisions.

In the end, no matter how you frame it, the more convincing the argument for the benefits of the ‘deep dive,’ the less effective the company’s decision-making likely is.

This is not to say that all in-depth exercises are always a sign of ineffective decision-making; rather, those with an annual cadence—established practices that take months to complete and involve large parts of the organization, such as Annual Strategic Planning or Annual Budgeting—likely are.

Practical insights

- The need for a regular deep dive implies lack of understanding of the business.

- Decisions for which a heavy annual deep dive is ‘optimal’ do not exist.

- The greater the deep dive’s benefits, the less effective the decision-making.